2018 Proxy Statement to hold office until the next Annual Meeting of Shareholders and until their respective successors have been duly elected and qualified, (2) approve the advisory resolution to approve Named Executive Officers’ compensation, and (3) ratify the appointment of KPMG LLP, an independent registered public accounting firm, as the Company’s auditors for the year ending December 31, 2016.Shareholders may also be asked to consider and take action with respect to such other matters as may properly come before the Annual Meeting.

Copies of the Company’s Annual Report on Form 10-K for the year ended December 31, 2015 (“Annual Report”), including the Company’s audited consolidated financial statements, were made available to known Shareholders on or about February 29, 2016.

| • General Information | | 1 | 2016 Proxy Statement • General Information | | 1 |

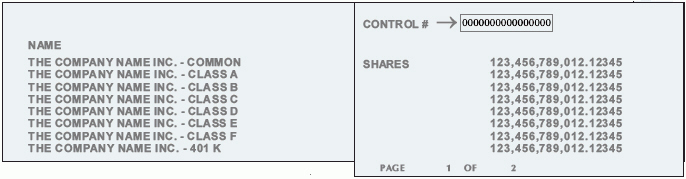

Your Proxy Vote How to Vote | (1) | Via Internet: Go to www.proxyvote.com to vote via the Internet. You will need to follow the instructions on your Notice of Internet Availability of Proxy Materials (“Notice”) or proxy card and the website. If you vote via the Internet, you may incur telephone and Internet access charges. |

| (2) | By Telephone: Call the toll-free telephone number on the proxy card or the website to vote by telephone. You will need to follow the instructions and the voice prompts. |

| (3) | By Mail: Request, complete and return a paper proxy card, following the instructions on your Notice. |

| (4) | In Person: Attend the Annual Meeting, or send a personal representative with an appropriate proxy, to vote by ballot. |

If you vote via the Internet or by telephone, your electronic vote authorizes the named proxies in the same manner as if you signed, dated and returned your proxy card.If you vote via the Internet or by telephone, do not return your proxy card. If your shares are held in “street name” (that is, in the name of a bank, broker or other holder of record), you will receive a Notice containing instructions from the holder of record that you must follow in order for your shares to be voted. Internet and/or telephone voting also will be offered to Shareholders owning shares through most banks and brokers. Participants in the Company’s stock fund within the Horace Mann Service Corporation Supplemental Retirement and Savings 401(k) Plan can direct the trustee to vote their shares via the Internet as directed in the Notice, by telephone as provided on the website or proxy card, or by signing and returning a proxy card. Voting Rules Solicitation and Revocation Your proxy is being solicited by and on behalf of the Board. The persons named in the Form of Proxy have been designated as proxies by the Board. Such persons are Directors of the Company. Shares of Common Stock represented at the Annual Meeting by a properly executed and returned proxy will be voted at the Annual Meeting in accordance with the instructions noted thereon, or if no instructions are noted, the proxy will be voted in favor of the proposals set forth in the Notice of Annual Meeting. A submitted proxy is revocable by a Shareholder at any time prior to it being voted, provided that such Shareholder gives written notice to the Corporate Secretary at or prior to the Annual Meeting that such Shareholder intends to vote in person or by submitting a subsequently dated proxy. Attendance at the Annual Meeting by a Shareholder who has given a proxy shall not in and of itself constitute a revocation of such proxy. Further solicitation may be made by officers and other employees of the Company personally, by telephone or otherwise, but such persons will not be specifically compensated for such services. Banks, brokers, nominees and other custodians and fiduciaries will be reimbursed for their reasonableout-of-pocket expenses in forwarding soliciting material to their principals, the beneficial owners of Common Stock. The costs of soliciting proxies will be borne by the Company. It is estimated these costs will be nominal. Shareholder Approval Shareholders are entitled to one vote per share of Common Stock on all matters submitted for consideration at the Annual Meeting. Under the Company’s Bylaws, the affirmative vote of a majority of the shares of Common Stock represented in person or by proxy at the Annual Meeting is required for the election of Directors, approval of the advisory resolution to approve Named Executive Officers’ compensation, and the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2016.2018. Abstentions have the same effect as a vote “against” approval of the matter. Please note that under New York Stock Exchange (“NYSE”) rules, brokers who hold | | | | 2 | | 2018 Proxy Statement • Your Proxy Vote |

shares of Common Stock in street name for customers have the authority to vote on certain items when they have not received instructions from beneficial owners. With respect to the matters to come before the Annual Meeting, if brokers are not entitled to vote without instructions and therefore cast brokernon-votes, the brokernon-votes will have no direct effect on the outcome of the vote. However, because each matter requires a majority vote of the outstanding shares present and entitled to vote, a brokernon-vote will indirectly work against the matter for which a brokernon-vote is cast. For this Annual Meeting, if you do not give specific instructions, your broker may cast your vote in its discretion on only Proposal No. 3 - Ratification of Independent Registered Public Accounting Firm. Other Matters Other than the matters set forth below, the Board has not received any Shareholder proposal by the deadline prescribed by the rules of the SEC,Securities and Exchange Commission (“SEC”), and otherwise knows of no other matters to be brought before the Annual Meeting. However, should any other matters properly come before the meeting, the persons named in the Form of Proxy will vote or refrain from voting thereon at their discretion. | | | 2 | | 20162018 Proxy Statement • Your Proxy Vote | | 3 |

Proposals and Company Information PROPOSAL NO. 1 - ELECTION OF NINE DIRECTORS The By-LawsBylaws of the Company provide for the Company to have not less than five or more than fifteen Directors. The following nine persons currently are serving as Directors of the Company (“Directors”): Daniel A. Domenech, Mary H. Futrell, Stephen J. Hasenmiller, Ronald J. Helow, Beverley J. McClure, H. Wade Reece, Gabriel L. Shaheen, Robert Stricker, Steven O. Swyers and Marita Zuraitis. The terms of these Directors expire at the Annual Meeting. Dr. Futrell will be retiring from the Board as of the Annual Meeting, and the Board has nominated H. Wade Reece to serve as a new Director of the Company. We thank Dr. Futrell for her exemplary service.Qualifications The Board of Directors believes it is necessary for each of the Company’s Directors to possess a variety of qualities and skills. The Nominating & Governance Committee conducts all necessary and appropriate inquiries into the background and qualifications of Board candidates including the determination of independence. In addition, the Nominating & Governance Committee has identified areas of expertise that it believes support the Company’s business strategy in the short and long-term, enable the Board to exercise its oversight function and contribute to a well-rounded Board. The list below highlights certain key qualifications and experience of our current Board. | | | | | ✓ Education Background | | ✓ Technology | | ✓ Leadership Background | ✓ Niche Market | | ✓ Financial Services | | ✓ Financial Expert | ✓ Insurance Operations | | ✓ Customer Experience | | ✓ Investments | ✓ Agency Management | | ✓ Insurance Brokerage | | |

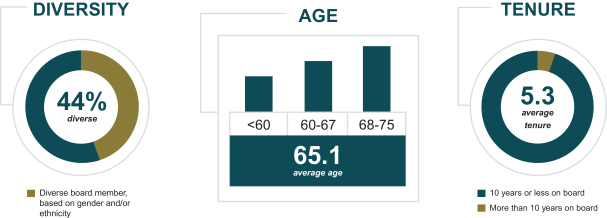

Board Diversity, Age and Tenure The Nominating & Governance Committee does not have a formal diversity policy; however, the Board and the Nominating & Governance Committee believe that it is important that the Board be comprised of individuals with expertise in fields relevant to the Company’s business, experience from different professions, a diversity of age, ethnicity and gender, and a range of tenures. The Nominating & Governance Committee is responsible for reviewing with the Board, on an annual basis, the requisite skills and characteristics of new Board members as well as the composition of the Board as a whole. This assessment includes members’ qualifications as independent,consideration of experience, perspective, background, skill sets, age, ethnicity, and gender makeup of the current Board as well as consideration of skills, experience, diversitythe candidate’s individual qualities in leadership, character judgment and ethical standards. | | | | 4 | | 2018 Proxy Statement • Proposals and Company Information |

Diversity age in the context of the needs of the Board. tenure

The Nominating & Governance Committee does not havebelieves our Board Nominees (as identified below) represent a formaldiverse base of perspectives and reflect the diversity policy; however,of the Company’s employees, customers and Shareholders, as well as an appropriate level of age and tenure, as further illustrated below.

Board Refreshment The Board and the Nominating & Governance Committee believe that it is essential thatregularly consider the long-term make up of the Board and how the members represent diverse viewpoints.of the Board change over time. The Board and Nominating & Governance Committee assessesunderstand the effectivenessimportance of Board refreshment and strive to balance the criteria described above when evaluating new Board candidates and when assessing the composition ofknowledge that comes from longer-term service on the Board aswith the new experience, ideas and energy that can come from adding directors to the Board. Directors who are 75 years of age or older may not stand for election in the absence of a whole.specific finding by the Board that there are special circumstances to justify an exception, which supports Board refreshment. As Horace Mann continues to focus on profitable growth across all lines of business, the ongoing transformation of its technology and operations, and exploring inorganic growth opportunities, we will continue to consider Board refreshment opportunities. | | | | 2018 Proxy Statement • Proposals and Company Information | | 5 |

Board Nominees Upon the recommendation of the Nominating & Governance Committee, the Board nominated Dr. Domenech, Mr. Hasenmiller, Mr. Helow, Mr. Hines, Ms. McClure, Mr. Reece, Mr. Shaheen, Mr. Stricker, Mr. Swyers and Ms. Zuraitis (the “Board Nominees”) to hold office as Directors. The proxies solicited by and on behalf of the Board will be voted “FOR” the election of the Board Nominees unless you specify otherwise. The Company has no reason to believe that any of the foregoing Board Nominees is not available to serve or will not serve if elected, although in the unexpected event that any such Board Nominee should become unavailable to serve as a Director, full discretion is reserved to the persons named as proxies to vote for such other persons as may be nominated, or the Board may reduce the size of the Board. Each Director will serve until the next Annual Meeting of Shareholders and until his or her respective successor is duly elected and qualified. Board Nominees

The following information, as of March 15, 2016,2018, is provided with respect to each Board Nominee: | | | | | | | | |

| | Daniel A. Domenech Age: 7072 Director Since: 2015 Horace Mann Committees: Customer Experience & Technology InvestmentNominating & FinanceGovernance

| | Dr. Domenech has served as the Executive Director of American Association of School Administrators (“AASA”), The School Superintendents Association, a professional organization for educational leaders, since July 2008. He is currently Chairman of the Board of the Communities in Schools of Virginia and the National Student Clearinghouse Research Center and is a member of the Board of Directors of Learning First Alliance, America’s Promise, the Center for Naval Analyses, ACT and Universal Service Administrative Company (“USAC”). where he Chairs the Schools and Libraries Committee. Dr. Domenech is also a past President of the New York State Council of School Superintendents, the Suffolk County Superintendents Association and the Suffolk County Organization for Promotion of Education, and was the first President and cofounder of the New York State Association for Bilingual Education. In addition, he has served on the U.S. Department of Education’s National Assessment Governing Board, on the Advisory Board for the Department of Defense schools, on the Board of Directors for the Baldrige Award and on the National Board for Professional Teaching Standards. Dr. Domenech has more than 40 years of experience in public education. Dr. Domenech’s experience in public education provides the Board with valuable insight into the Company’s niche market and the challenges and opportunities within that market. |

| | | 20166 | | 2018 Proxy Statement • Proposals and Company Information | | 3 |

| | | | | | | | |

| | Stephen J. Hasenmiller Age: 6668 Director Since: 2004 Horace Mann Committees: Compensation (Chair) ExecutiveAudit

Nominating & GovernanceExecutive

| | Mr. Hasenmiller retired in March 2001 after 24 years of service at The Hartford Financial Services Group, Inc., as Senior Vice President - Personal-Personal Lines. Mr. Hasenmiller’s prior affiliations include his tenure as Chairman of the Personal Lines Committee of the American Insurance Association (1999-2001) and membership on the Boards of Directors of the Institute for Business & Home Safety (1996-2001) and the Insurance Institute for Highway Safety (1995-2001). Mr. Hasenmiller’s seasoned insurance background in the personal lines business, including both direct sales and agency distribution, as well as his understanding and experience in dealing with complex insurance issues, provides the Board with a valuable perspective. | | | |

| | Ronald J. Helow Age: 7173 Director Since: 2009 Horace Mann Committees: Customer Experience & Technology (Chair) AuditExecutive

ExecutiveNominating & Governance

| | Mr. Helow is managing director of New Course Advisors, a consulting firm he founded in 2008 to advise companies on how to use advanced technologies to create a competitive advantage. Mr. Helow served from 2001 to 2008 as Partner and Chief Technology Officer at NxtStar Ventures, LLC, a firm providing consulting services to life insurance and retail financial services businesses, and founded Registry Systems Corporation in 1990 to custom design and implement mission critical projects using advanced computer technologies for insurance companies. Mr. Helow’s past experience in developing and securing solutions to insurance company operating challenges through technology brings to the Board unique knowledge and perspective. |

| | | | 2018 Proxy Statement • Proposals and Company Information | | 7 |

| | | | | | | |  | | Perry G. Hines Age: 55 Board Nominee | | Mr. Hines is a retired corporate marketing executive and is the principal and owner of The Hines Group, LLC, a firm he formed in 2006 specializing in marketing, communications and strategic planning. He has over 27 years of cross-sector experience in general management, brand, communications and marketing. Mr. Hines previously served as Senior Vice President, Chief Marketing and Communications Officer for Irwin Mortgage Corporation, a position he held from 2002 to 2007, Senior Vice President, Chief Marketing and Sales Officer of Lincoln Reinsurance Corporation from 1998 to 2002 and Vice President of Marketing & Communications of Safeco from 1995 to 1998. He has held management roles and stewarded well-known household brands. In addition to his consulting practice, he currently serves as the Director of Advancement for Covenant Christian High School. Mr. Hines’ cross-sector expertise in general management, brand building and strategic marketing will bring unique perspective and insight to the Board. | | | |  | | Beverley J. McClure Age: 6163 Director Since: 2013 Horace Mann Committees: Audit Compensation Customer Experience & Technology | | Ms. McClure retired in 2007 after a 35 year career with United Services Automobile Association (“USAA”), as Senior Vice President, Enterprise Operations. She is owner of Fresh Perspectives LLC, a firm she founded in 2007 which specializes in executive coaching and small business consulting. Ms. McClure previously served as Senior Advisor of Endeavor Management, a consulting firm specializing in service culture creation, leadership coaching, business transformation, operational execution, and customer experience management, a position she held from 2010 to 2013. She holds the Chartered Life Underwriter and Fellow, Life Management Institute designations and is a certified executive coach through the International Coach Federation. Ms. McClure’s broad experience in the areas of service excellence, customer experience, culture creation, employee engagement and quality management provides the Board with a valuable perspective. |

| | | 48 | | 20162018 Proxy Statement • Proposals and Company Information |

| | | | | | | | |

| | H. Wade Reece Age: 5961 Board NomineeDirector Since:2016

Horace Mann Committees: Customer Experience & Technology Investment & Finance Nominating & Governance | | Mr. H. Wade Reece retired in 2015 after a 37 year career with BB&T Corporation (“BB&T”) where he served as the Chairman of the Board and Chief Executive Officer of BB&T Insurance Services, Inc. and BB&T Insurance Holdings, Inc., the sixth largest insurance broker globally. Until his retirement in 2015, Mr. Reece served as Vice Chairman of the Foundation of Agency Management Excellence (“FAME”) Board of Directors and a member of the Executive Committee of The Institutes (American Institute for Chartered Property Casualty Underwriters and Insurance Institute of America). He was also a past Chairman of the Council of Insurance Agents & Brokers and past Chairman of the Board of Trustees of The Institutes. Mr. Reece currently is a member of the Board of Directors of the North Carolina State University Foundation and the Blue Ridge Conservancy. Mr. Reece’sin-depth knowledge of the insurance industry, leadership skills and broad experience with agency management will provide the Board with industry insight and perspective. | | | |

| | Gabriel L. Shaheen

Age: 62

Director Since: 2007

Chairman Since: 2010

Horace Mann Committees:

Executive (Chair)

Nominating & Governance (Chair)

Compensation

| | Mr. Shaheen retired in 1999 after 22 years of service with Lincoln National Corporation, including service as President and Chief Executive Officer of Lincoln National Life Insurance Company, Managing Director of Lincoln UK, and President and Chief Executive Officer of Lincoln National Reinsurance Companies. Since 2000, he has been Chief Executive Officer of GLS Capital Ventures, LLC and Partner of NxtStar Ventures, LLC, firms providing consulting services to life insurance and retail financial services businesses. He is currently a member of the Board of Directors of M Financial Holdings Incorporated and Steel Dynamics, Inc., one of the largest steel producers and metals recyclers in the United States. Mr. Shaheen holds the Fellow of the Society of Actuaries designation.

Mr. Shaheen’s insurance experience, technical insurance expertise and leadership background are valuable Board resources and contribute to Board discussion of issues impacting the Company.

| | | |

| | Robert Stricker Age: 6971 Director Since: 2009 Horace Mann Committees: Investment & Finance (Chair) Audit

Customer Experience & Technology | | Mr. Stricker retired from Shenkman Capital Management, Inc., an investment management firm, in March 2009 as Senior Vice President and Principal. Prior to joining Shenkman, he served as Managing Director, Head of U.S. Fixed Income, Citigroup Asset Management at Citigroup, Inc. from 1994 to 2001. Mr. Stricker has over 40 years of experience in the financial services industry. He currently serves as a Director of the CQS Directional Opportunities Feeder Fund Ltd. and on the OPEB Trust Board of the town of Greenwich, Connecticut. Mr. Stricker holds the Chartered Financial Analyst designation. Mr. Stricker’s investment knowledge and financial services industry experience provide the Board with financial insights and assist the Board in its oversight responsibilities. |

| | | 20162018 Proxy Statement • Proposals and Company Information | | 59 |

| | | | | | | | |

| | Steven O. Swyers Age: 6567 Director Since: 2014 Horace Mann Committees: Audit (Chair) Investment & Finance | | Mr. Swyers retired in 2013 after a 40 year career with PricewaterhouseCoopers LLP (“PwC”), a public accounting firm. During this time with PwC, he served as the lead engagement partner on many national and international companies, including those in the financial services industry. He has also held various leadership positions at PwC including leader of the Central Region’s consumer and industrial products business segment and managing partner of their St. Louis practice. He is currently a member of the Board of Directors of Mercy Health East Communities and Webster University.Communities. Mr. Swyers holds the Certified Public Accountant designation. Mr. Swyers has an extensive audit and accounting background and is recognized as a financial expert. His knowledge in these areas assists the Board in its oversight responsibilities. |

| | | | 10 | | 2018 Proxy Statement • Proposals and Company Information |

| | | | | | | | |

| | Marita Zuraitis Age: 5557 Director Since: 2013 Horace Mann Committees: Customer Experience & Technology Executive Investment & Finance | | Ms. Zuraitis was appointed to her present position as President and Chief Executive Officer in September 2013. She joined the Company in May 2013 as President and Chief Executive Officer-Elect. Ms. Zuraitis joined Horace Mann from The Hanover Insurance Group where she was an Executive Vice President and a member of The Hanover’s Executive Leadership Team. From 2004 to 2013, she served as President, Property and Casualty Companies, responsible for the personal and commercial lines operations at Citizens Insurance Company of America, The Hanover Insurance Company and their affiliates. Prior to 2004, Ms. Zuraitis was with The St. Paul/Travelers Companies for six years, where she achieved the position of President and Chief Executive Officer, Commercial Lines. She also held a number of increasingly responsible underwriting and field management positions with United States Fidelity and Guaranty Company and Aetna Life and Casualty. She is a member of the Board of Directors of LL Global, Inc., a trade association with operating divisions LIMRA and LOMA, and a memberVice Chair of the Board of Trustees of The Institutes, the leading provider of risk management and property-casualty insurance education, whose offerings include the premier CPCU® designation.designation, and a past member of the Board of Directors of LL Global, Inc., a trade association with operating divisions LIMRA and LOMA. She is also a member of the Board of Directors of Citizens Financial Group, Inc. Ms. Zuraitis has over 30 years of experience in the insurance industry. Ms. Zuraitis’s knowledge of and extensive background in the insurance industry contribute to Board discussion and understanding of issues impacting the Company. |

All of the Board Nominees were elected Directors at the last Annual Meeting of Shareholders of the Company held on May 20, 2015,24, 2017, with the exception of Mr. Reece,Hines, who was identified by a retained executive search firm working with the Directors of the Company and recommended for nomination as a Director by the Company’s Nominating and Governance Committee. The Board recommends that Shareholders vote FOR the election of these nine nominees as Directors. | | | | 2018 Proxy Statement • Proposals and Company Information | | 11 |

Board of Directors and Committees There were nine members on the Board as of March 15, 2016.2018. The Board met fiveseven times during 2015.2017. No Director of the Company attended fewer than 75% of the Board meetings and the committee meetings to which he or she was appointed and served during 2015.2017. The Chairman of the Board presides over all executive sessions of the Board, including executive sessions ofnon-employee Directors, and may be contacted as described in “Corporate Governance - Communications with Directors”. The members of the Board are expected to be present at the Annual Meeting. The following nineeight Directors serving on the Board at the time of last year’s Annual | | | 6 | | 2016 Proxy Statement • Proposals and Company Information |

Meeting attended the meeting: Dr. Futrell, Mr. Hasenmiller, Mr. Helow, Ms. McClure, Mr. Shaheen,Reece, Mr. Steinbecker,Shaheen, Mr. Stricker, Mr. Swyers and Ms. Zuraitis. Committees of the Board The standing committees of the Board consist of the Executive Committee, Compensation Committee, Nominating & Governance Committee, Investment & Finance Committee and Audit Committee. Each standing committee is governed by a charter that defines its role and responsibilities which are available on the Company’s website at www.horacemann.com under “Investors - Corporate Overview - Committee-Committee Composition and Charters”. A printed copy of these charters may be obtained by Shareholders upon written request addressed to Investor Relations, Horace Mann Educators Corporation, 1 Horace Mann Plaza,C-120, Springfield, Illinois 62715-0001. The Board may also form ad hoc committees from time to time. TheExecutive Committee exercises certain powers of the Board during intervals between meetings of the Board and, as requested by the Chief Executive Officer, acts as a sounding board for discussing strategic and operating issues. TheCompensation Committee approves and recommends to the Board the compensation, salaries, bonuses and awards applicable to the Executive Officers and Directors of the Company and oversees the process of Executive Officer leadership development and succession. Each of the current members of this Committee is independent under the listing standards of the NYSE applicable to compensation committee members. The Compensation Committee receives recommendations from management and has unrestricted access to the Company’s personnel documents and to reports or evaluations of any independent compensation consultants, specialists or advisors who are retained by the Company or the Compensation Committee to analyze the compensation of the Executive Officers and members of the Board. The Compensation Committee also has access to any other resources which it needs to discharge its responsibilities, including selecting, retaining and/or replacing, as needed, compensation consultants and other outside consultants to provide independent advice to the Compensation Committee. Additional information regarding the processes and procedures for the consideration and determination of Executive Officer compensation is provided in the “Compensation Discussion and Analysis”. TheNominating & Governance Committee develops and recommends to the Board corporate governance principles applicable to the Company, oversees the Board succession planning process, and recommends Director candidates to the Board. The Nominating & Governance Committee will consider Director candidates recommended by Shareholders. Candidates may be submitted in writing to the Corporate Secretary, Horace Mann Educators Corporation, 1 Horace Mann Plaza, Springfield, Illinois 62715-0001. There are no differences between the evaluation of candidates recommended by Shareholders and the evaluation of candidates recommended by members of the Nominating & Governance Committee. The Committee evaluates possible nominees to the Board on the basis of the factors it deems relevant, including the following: high standards of personal character, conduct and integrity; | | | | 12 | | 2018 Proxy Statement • Proposals and Company Information |

an understanding of the interests of the Company’s Shareholders, clients, employees, agents, suppliers, communities and the general public; the intention and ability to act in the interest of all Shareholders; a position of leadership and substantial accomplishment in his or her field of endeavor, which may include business, government or academia; the ability to understand and exercise sound judgment on issues related to the goals of the Company; a willingness and ability to devote the time and effort required to serve effectively on the Board, including preparation for and attendance at Board and committee meetings; the absence of interests or affiliations that could give rise to a biased approach to directorship responsibilities and/or a conflict of interest, and the absence of any significant business relationship with the Company except for the employment relationship of an employee Director; and the needs of the Board, including skills, experience, diversity and age. TheInvestment & Finance Committee approves investment strategies, monitors the performance of investments made on behalf of the Company and its subsidiaries, and oversees issues and decisions relating to the Company’s capital structure. TheAudit Committee oversees the accounting and financial reporting process, audits of the financial statements, and internal operating controls of the Company. It meets with both the Company’s management and the Company’s independent registered public accounting firm. Each of the current members of this Committee is independent under the independence standards of the NYSE applicable to audit committee members. No Audit Committee member serves on the audit committee of more than three other publicly traded companies. The Board has determined that Mr. Swyers, the Chair of our Audit Committee, is a financial expert. Mr. Swyers retired in 2013 from PricewaterhouseCoopers LLP, a public accounting firm, after a 40 year career where he served as the lead engagement partner on many national and international companies, including those in the financial services industry. He also held various leadership positions including leader of the Central Region’s consumer and industrial products business segment and managing partner of their St. Louis practice. TheCustomer Experience & Technology Committeeis an ad hoc committee formed by the Board during 2013. The Committee oversees the Company’s goals and strategies related to improving and managing the customer experience, as well as the development and implementation of the Company’s technology strategies. | | | 20162018 Proxy Statement • Proposals and Company Information | | 713 |

The following table identifies membership and the Chairman of each of the current committees of the Board, as well as the number of times each committee met during 2015.2017. | | | | | | | | | | | | | | | | | Director | | Executive

Committee | | Compensation Committee | | Nominating & Governance

Committee | | Investment & Finance

Committee | | Audit

Committee | | Customer

Experience & Technology

Committee (1) | | Executive

Committee | | Compensation Committee | | Nominating & Governance

Committee | | Investment & Finance

Committee | | Audit

Committee | | Customer

Experience & Technology

Committee (1) | | | | | | | | | | Daniel A. Domenech | | | | | | | | X | | | | X | | | | | | X | | | | | | X | Mary H. Futrell | | | | X | | X | | | | | | X | | | | | | | | | | | Stephen J. Hasenmiller | | X | | Chair | | X | | | | | | | | X | | Chair | | | | | | X | | | | | | | | | | | | Ronald J. Helow | | X | | | | | | | | X | | Chair | | X | | | | X | | | | | | Chair | | | | | | | | | | Beverley J. McClure | | | | X | | | | | | X | | X | | | | X | | | | | | X | | X | | | | | | | | | | H. Wade Reece | | | | | | | X | | X | | | | X | | | | | | | | | | Gabriel L. Shaheen | | Chair | | X | | Chair | | | | | | | | Chair | | X | | Chair | | | | | | | | | | | | | | | | Robert Stricker | | | | | | | | Chair | | X | | X | | | | | | | | Chair | | | | X | | | | | | | | | | Steven O. Swyers | | | | | | | | X | | Chair | | | | | | | | | | X | | Chair | | | | | | | | | | | | Marita Zuraitis | | X | | | | | | X | | | | X | | X | | | | | | X | | | | X | Meetings in 2015 | | 0 | | 5 | | 4 | | 4 | | 12 | | 4 | | | | | | | | | | | | Meetings in 2017 | | | 0 | | 5 | | 4 | | 4 | | 12 | | 4 |

Chair - Committee Chair X - Committee member | (1) | The Customer Experience & Technology Committee is an ad hoc committee. |

| | | | 14 | | 2018 Proxy Statement • Proposals and Company Information |

Director Compensation The compensation program fornon-employee Directors is shown in the following table: | | | | | Compensation Element | | Non-Employee Director Compensation (1)(2) | | | Board Chairman Annual Retainer | | $100,000 115,000 | | | Board Member Annual Retainer

(other than Board Chairman) | | $55,000 60,000 | | | Committee Chairman Annual Retainer | | $25,000 Audit Committee $15,000 Compensation Committee $12,000 Nominating & Governance Committee $15,000 Customer Experience & Technology Committee

$10,000 all other Committees15,000 Investment & Finance Committee $12,000 Nominating & Governance Committee | | | Committee Member Annual Retainer

(other than Committee Chairman) | | $10,000 Audit Committee $ 7,500 all other Committees (3) | | | Share-based Compensation | | Fair value on the date of the respective awards is used to determine the number of Restricted Stock Units (“RSUs”) awarded. An annual award of $90,000$95,000 in RSUs following the Annual Shareholder Meeting. $90,000$95,000 in RSUs if joining the Board within 6 months after the prior Annual Shareholder Meeting, $45,000$47,500 in RSUs if joining more than 6 months after the prior Annual Shareholder Meeting but before the next Annual Shareholder Meeting. All awards have a 1 year vesting period. | | | Basic Group Term Life Insurance | | Premium for $10,000 face amount | | | Business Travel Accident Insurance | | Premium for $100,000 coverage |

| (1) | Annual retainer fees are paid following the Annual Shareholder Meeting each year. The annual retainer fees are prorated to the extent that anon-employee Director joins the Board after the Annual Shareholder Meeting. |

| (2) | Non-employee Directors may elect to defer cash compensation into Common Stock equivalent units (“CSUs”). RSUs. |

| (3) | All other Committees except for the Executive Committee which is not paid an Annual Retainer. |

| | | Non-employee Directors are required to hold shares of HMEC Common Stock with a book value equal to five times their annual cash retainer. | | |

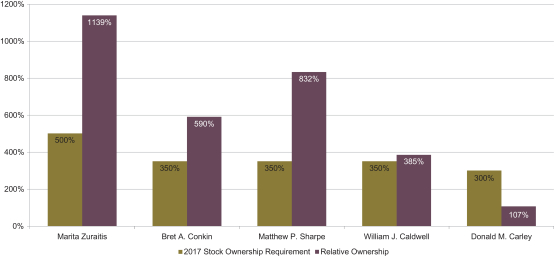

Untilnon-employee Directors meet this ownership requirement, they must retain all Common Stock equivalent units and Restricted Stock UnitsRSUs granted as share-based compensation (net of taxes). All As of December 31, 2017, allnon-employee Directors have met the guidelines with the exception of Mr. Swyers, who joined the Board in 2014, and Dr. Domenech,Mr. Reece, who joined the Board in 2015, and they2016. They have 5 years to meet this requirement. Employee Directors do not receive compensation for serving on the Board and are subject to separate stock ownership guidelines. See “Compensation Discussion and Analysis - Stock–Stock Ownership and Holding Requirements”. | | | 8 | | 20162018 Proxy Statement • Proposals and Company Information | | 15 |

The following table sets forth information regarding compensation earned by, or paid to, thenon-employee Directors during 2015:2017: | | | | | | | | | | | | | | | Director | | Fees Earned

or Paid in Cash ($) | | | Stock Awards

($) (1) | | | All Other

Compensation

($) (2) | | | Total

($) | | | Fees Earned

or Paid in Cash ($) | | Stock Awards

($) (1) | | All Other

Compensation

($) (2) | | | Total

($) | | | | | | | Daniel A. Domenech | | | 0 | | | | 160,000 | | | | 102 | | | | 160,102 | | | 0 | | | 170,000 | | | 204 | | | | 170,204 | | Mary H. Futrell | | | 38,750 | | | | 128,750 | | | | 204 | | | | 167,704 | | | | | | | | Stephen J. Hasenmiller | | | 85,000 | | | | 90,000 | | | | 204 | | | | 175,204 | | | 85,000 | | | 95,000 | | | 204 | | | | 180,204 | | | | | | | Ronald J. Helow | | | 87,500 | | | | 90,000 | | | | 204 | | | | 177,704 | | | 82,500 | | | 95,000 | | | 204 | | | | 177,704 | | | | | | | Beverley J. McClure | | | 80,000 | | | | 90,000 | | | | 51 | | | | 170,051 | | | 85,000 | | | 95,000 | | | 51 | | | | 180,051 | | | | | | | H. Wade Reece | | | 82,500 | | | 95,000 | | | 51 | | | | 177,551 | | | | | | | Gabriel L. Shaheen | | | 129,500 | | | | 90,000 | | | | 51 | | | | 219,551 | | | 134,500 | | | 95,000 | | | 51 | | | | 229,551 | | | | | | | Robert Stricker | | | 82,500 | | | | 90,000 | | | | 204 | | | | 172,704 | | | 82,500 | | | 95,000 | | | 204 | | | | 177,704 | | | | | | | Steven O. Swyers | | | 87,500 | | | | 90,000 | | | | 204 | | | | 177,704 | | | 92,500 | | | 95,000 | | | 204 | | | | 187,704 | |

| (1) | Represents fees deferred in 20152017 pursuant to the HMEC 2010 Comprehensive Executive Compensation Plan, as well as $90,000$95,000 in RSUs (awarded May 20, 2015)24, 2017). As of December 31, 2015,2017, each Director had 2,6022,538 unvested RSUs. |

| (2) | Represents insurance premiums provided by the Company for group term life insurance and business travel accident insurance for each Director. The group term life insurance premiums areage-banded and this is reflected in the lower premiums for Ms. McClure, Mr. Reece and Mr. Shaheen. In addition, Dr. Domenech’s premiums were pro-rated based on the date that he joined the Board. |

Corporate Governance Director Independence The Company’s Corporate Governance Principles require that the Board consist of a majority of directors who meet the criteria for independence required by the listing standards of the NYSE. Based on the independence requirements of the NYSE and after reviewing any relationships between the Directors and the Company or its management (either directly or indirectly, including as a partner, shareholder or officer of an organization that has a relationship with the Company or its management) that could impair, or appear to impair, the Director’s ability to make independent judgments, the Board determined that none of itsnon-employee Directors have a material relationship with the Company, and therefore all of these Directors are independent. In addition, the Board determined that Mr. Reece does not have a material relationship with the Company, and therefore is independent. These independence determinations are analyzed at least annually in both fact and appearance to promote arms-length oversight. The currentnon-employee Directors are Dr. Domenech, Dr. Futrell, Mr. Hasenmiller, Mr. Helow, Ms. McClure, Mr. Reece, Mr. Shaheen, Mr. Stricker and Mr. Swyers. Board Leadership Structure The Board is committed to strong, independent Board leadership and believes that objective oversight of management is a critical aspect of effective corporate governance. Accordingly, the Board currently has two separate individuals holding the offices of Chairman and Chief Executive Officer, and the position of Chairman is held by an independent Director. The Board of Directors believes that having an independent Director serve as Chairman is in the best interest of the Company at this time as this structure provides a greater role for the independent Directors in the oversight of the Company. However, as described in the Company’s Corporate Governance Principles, this situation can change in the future to permit one individual to hold both positions, if the Board deems it to be in the best interests of the Company at a given time. Board’s Role in Risk Oversight The Board of Directors is responsible for overseeing the processes that management has established for assessing and managing risk. In addition, the Board has delegated oversight of certain categories of risk to designated Board committees. In performing their oversight responsibilities, the Board and relevant committees regularly discuss with management the Company’s policies with respect to risk | | | | 16 | | 2018 Proxy Statement • Proposals and Company Information |

assessment and risk management. The committees report to the Board regularly on matters relating to the specific areas of risk the committees oversee. In addition, the Company has established an internal Enterprise Risk Management (“ERM”) Committee, which is composed of certain members of senior management including the President and Chief Executive Officer; the Executive Vice President and Chief Financial Officer; the Executive Vice President, Annuity and Life; the Executive Vice President, Property & Casualty; the Senior Vice President and Chief Human Resources Officer; the Senior Vice President, Field Operations and Distribution; the Senior Vice President and Chief Information Officer; the General Counsel and Chief Compliance Officer; and the Corporate Secretary.heads of Field Operations and Distribution, Business Development and the Life & Retirement and Property & Casualty divisions. The ERM Committee is chaired by the Executive Vice President and Chief Financial Officer of the Company. Throughout the year, the Board and the relevant Board committees receive regular reports from the Enterprise Risk ManagementERM Committee and its chairman regarding major risks and exposures facing the Company and the steps management has taken to monitor and control such risks and exposures. In addition, throughout the year, the Board and the relevant Board committees dedicate a portion of their meetings to review and discuss specific risk topics in greater detail. Also, in light of ongoing threats to corporate cybersecurity, the Board and relevant Board Committees receive regular reports from the Chief Information Officer of the Company regarding cybersecurity risks and the steps management has taken to monitor and control such risks. The Audit Committee dedicates a portion of their meetings to review and discuss the Company’s cybersecurity program. | | | 2016 Proxy Statement • Proposals and Company Information | | 9 |

Code of Ethics, Code of Conduct and Corporate Governance Principles The Company has adopted a Code of Ethics and a Code of Conduct applicable to all employees, including the Chief Executive Officer, Chief Financial Officer, Controller and Directors (in their capacity as Directors of the Company). The Company has also adopted Corporate Governance Principles. The Codes and Principles are available on the Company’s website at www.horacemann.com, under “Investors - Corporate Overview - Governance Documents”.Documents.” A printed copy of the Codes and Principles may be obtained by Shareholders upon written request, addressed to Investor Relations, Horace Mann Educators Corporation, 1 Horace Mann Plaza,C-120, Springfield, Illinois 62715-0001. Corporate Social Responsibility Horace Mann works hard to be a responsible corporate citizen, and is guided by its high standards and mission to serve educators across the country. Horace Mann’s Corporate Social Responsibility Report provides anin-depth view of the ways in which Horace Mann has a positive impact on its customers, employees, Shareholders and the communities in which Horace Mann does business. The Board encourages Shareholders to review the Corporate Social Responsibility Report which is available on the Company’s website at www.horacemann.com, under “Investors - Corporate Overview - Corporate Social Responsibility.” Director Education Each Director is required to participate in at least one education program every two years and may choose to participate in up to two education programs in a two yeartwo-year period at the Company’s expense. All Directors are in compliance with this requirement. Communications with Directors The Company has established various processes to facilitate communications with the Board by Shareholders and other interested parties. Communications tonon-employee Directors as a group or to the Chairman of the Board or to an individual Director may be submitted via regular mail addressed to the Board of Directors, c/o the Corporate Secretary, Horace Mann Educators Corporation, 1 Horace Mann Plaza, Springfield, Illinois 62715-0001. Additionally, communications may be emailed to the Board of Directors, c/o the Corporate Secretary at hmecbofd@horacemann.com. Compensation Committee Interlocks and Insider Participation There are no Compensation Committee interlocks between the Company and other entities involving the Company’s Executive Officers and Directors who serve as executive | | | | 2018 Proxy Statement • Proposals and Company Information | | 17 |

officers or directors of such other entities. During 2015,2017, no member of the Compensation Committee was a current or former officer or employee of the Company. Review, Approval or Ratification of Transactions with Related Persons The Board reviews issues involving potential conflicts of interest of its members and is responsible for reviewing and approving all related party transactions. The Board does not have a formal related party transaction policy but it considers each related party transaction individually. Related Person Transactions BlackRock, Inc. (“BlackRock”), which owns beneficially more than 5% of the issued and outstanding shares of Common Stock, provides investment risk management services to the Company and has done so for more than 10 years. In 2015,2017, the Company paid approximately $0.5 million$524,809 in fees to BlackRock associated with the Company’s use of analytical software owned by BlackRock. Other than the BlackRock relationship, the Company does not have any contracts or other transactions with related parties that are required to be reported under the applicable securities laws and regulations. PROPOSAL NO. 2 - ADVISORY RESOLUTION TO APPROVE NAMED EXECUTIVE OFFICERS’ COMPENSATION The Board is asking Shareholders to approve an advisory resolution to approve the compensation of the Company’s NamedChief Executive Officer, Chief Financial Officer and the other three highest compensated Executive Officers (“NEOs”employed at the end of 2017 (collectively the “Named Executive Officers” or “NEOs”) as reported in this Proxy Statement. The Compensation Committee has structured our NEOs’ compensation program as described below under “Compensation Discussion and Analysis”.Analysis.” The Board recommends that Shareholders read the “Compensation Discussion and Analysis” (“CD&A”) included in this Proxy Statement, which describes in more detail how our Executive Compensation policies and procedures operate and are designed to achieve our compensation objectives, as well as the “Summary Compensation Table” and other related compensation tables and narrative included within the CD&A, which provide detailed information on the compensation of our NEOs. The Compensation Committee and the Board of Directors believe that the policies and procedures articulated in the CD&A are effective in achieving our goals. In accordance with Section 14(a) of the Securities Exchange Act, and as a matter of good corporate governance, the Board is asking Shareholders to approve the following advisory resolution at the 20162018 Annual Meeting: RESOLVED, that the Shareholders of Horace Mann Educators Corporation (the Company) approve, on an advisory basis, the compensation of the Company’s Named Executive Officers disclosed in the Compensation Discussion and Analysis, the Summary Compensation Table and the related compensation tables, notes and narrative in the Proxy Statement for the Company’s 20162018 Annual Meeting of Shareholders. This advisory resolution, commonly referred to as a “Say on Pay” resolution, isnon-binding on the Board of Directors. Althoughnon-binding, the Board and the Compensation Committee will review and consider the voting results when making future decisions regarding our NEOs’ compensation program. The Board has adopted a policy providing for an annual advisory vote to approve NEOs’ compensation. Unless the Board modifies its policy on the frequency of holding such advisory votes, the next advisory vote will occur at the Company’s 20172019 Annual Meeting of Shareholders. The Board recommends that Shareholders vote FOR the approval of the advisory resolution to approve Named Executive Officers’ compensation. | | | 1018 | | 20162018 Proxy Statement • Proposals and Company Information |

Compensation Discussion and Analysis | | | | | In this section, we describe the material components of our executive compensation program for our Named Executive Officers, or “NEOs,”NEOs, whose compensation is displayed in the 20152017 Summary Compensation Table and the other compensation tables contained in this Proxy Statement. We also provide an overview of our executive compensation philosophy and we explain how and why the Compensation Committee of our Board (the “Committee”) arrives at specific compensation policies and decisions. Our 20152017 NEOs are our Chief Executive Officer (“CEO”), Chief Financial Officer (“CFO”) and the three other most highly compensated Executive Officers employed at the end of 2015:2017: Marita Zuraitis, President and Chief Executive Officer;CEO; Dwayne D. Hallman,Bret A. Conklin, Executive Vice President and Chief Financial Officer;CFO*;

Matthew P. Sharpe, Executive Vice President, AnnuityLife & Retirement and Life;Business Development; William J. Caldwell, Executive Vice President, Property & Casualty and Casualty;Customer Engagement; and Kelly J. Stacy,Donald M. Carley, Senior Vice President, Field OperationsGeneral Counsel, Corporate Secretary, and Distribution.Chief Compliance Officer

*Note Regarding Chief Financial Officer On Feb. 3, 2017, our Executive Vice President and Chief Financial Officer, Dwayne D. Hallman, passed away. Bret A. Conklin was named Acting CFO on January 30, 2017, and was named Executive Vice President and Chief Financial Officer on April 13, 2017. Because Mr. Conklin was our CFO for the majority of 2017, we will include the compensation and pay decisions made with respect to him when discussing the compensation of our NEOs throughout this section. Compensation for Mr. Hallman is included in the 2017 Summary Compensation Table and other compensation tables contained in this Proxy Statement. We believe that this approach provides our Shareholders with a representative view of our pay programs with respect to our NEOs. | | |

Executive Summary This summary highlights information from this Compensation Discussion and Analysis section and may not contain all the information that is necessary to gain a full understanding of our policies and decisions. Please read the entire Compensation Discussion and Analysis section and compensation tables for a more complete understanding of our compensation program. Our Business We are a personal insurance and financial services business with approximately $10.1$11.2 billion of assets and approximately $1.2 billion in total revenue as of December 31, 2015.2017.Founded by Educators for Educators®, we offer our products and services primarily toK-12 teachers, administrators, and other employees of public schoolsschool employees and their families. We underwrite personal lines of auto, property and life insurance, andas well as retirement annuitiesproducts in the United States of America.States. 2015

| | | | 2018 Proxy Statement • Compensation Discussion and Analysis | | 19 |

2017 Business Highlights The Company delivered solid underlying financial results across all three segments of its multiline insurance platformbusiness in 2015.2017. Full year Operating Income was $2.00core earnings were $1.74 per diluted share. Book value per share* increased 6%6.2% in 20152017 driven by the solid operating results and positive contributions from investment portfolio performance.performance as well as the benefit related to the passage of the Tax Cuts and Jobs Act of 2017. In addition, we achieved broad-based increases in new business sales and solid policy retentions were achieved during the past year. Total Shareholder Return was 3.0%5.9% in 2015.2017 underperforming key insurance and general market indices that the Company outperformed the prior year.

* | Excluding the fair value adjustment for investments and including, for 2017, a $1.20 benefit related to the passage of the Tax Cuts and Jobs Act of 2017. |

These results reflect significant progress on numerous strategic initiatives, including: | • | | Increased sales levels year-over-year in all lines of business excluding life

New auto and property sales premium increased 5% and 4%, respectively Strong auto and property retention ratios Retirement deposits(fee-based and spread-based) comparable to the prior year Annuity assets under management increased by 9% Double digit growth in Life sales (13.5%) Solid earnings contribution from Life and Retirement P&C earnings impacted by significant adverse weather/catastrophes - Achieved 1 point of underlying auto combined ratio improvement - Property reported combined ratio of 97.0 despite record catastrophes |

| • | | New auto sales premium increased 7%

|

| • | | Auto policy-in-force growth of 1.2%

|

| • | | Horace Mann agency annuity sales increased 8% including the new fixed indexed annuity product

|

| • | | Strong auto and property retention ratios

|

| • | | Improved profitability in the underlying Property and Casualty book of business

|

| • | | Increased annuity assets under management by 5%

|

| • | | Introduction of new indexed universal life product

|

Please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in HMEC’s 20152017 Annual Report on andForm 10-K for a more detailed description of these financial results. | | | 201620 | | 2018 Proxy Statement • Compensation Discussion and Analysis | | 11 |

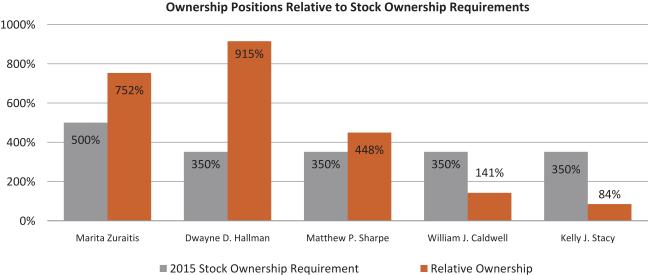

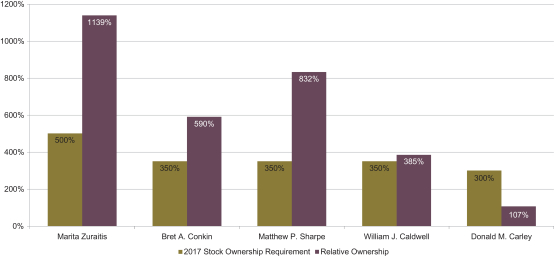

2017 Executive Compensation Highlights of Pay Practice and Governance | | | | | These elements of the executive compensation program are described more fully below. • Balanced pay Pay mix comprised of Base Salary,base salary, cash annual incentives under the Annual Incentive Plan (“AIP”), and equity-based long-term incentives under the Long-term Equity Incentive Awards, and Annual Cash IncentivesPlan (“LTIP”) • Over 70% of the CEO’s target compensation and over 56%60% of all other NEOs’ target compensation is linked to performance and service-basedperformance-based and/or equity-based incentives and is at risk • Balanced performance measures designed with a focus on shareholder return, both absolute and relative, and incenting profitableoperating growth while managing risk • Performance incentives tied to multiple overlapping performance periods • Annual cash incentives tied to Company and business line performance measures • Long-term incentives entirely equity-based: • Annual Incentive Plan tied to absolute performance measures

• Long-term Incentive Plan had been tied to all relative performance measures until the introduction of an absolute growth measure in 2015

• Long-term Incentives are entirely equity based

Ø Service-based stock options with a 4-year vesting period

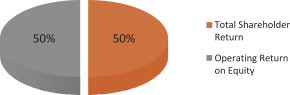

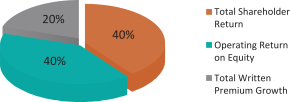

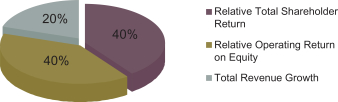

Ø➣ Performance-based RSUs vest following a3-year performance period, based on relative measures (relative total shareholder return and relative operating return on equity) and an absolute total written premium growth measure

Ø➣ Service-based RSUsService-vested stock options with a 3-year4-year vesting period

•➣ Service-vested RSUs with a3-year vesting period

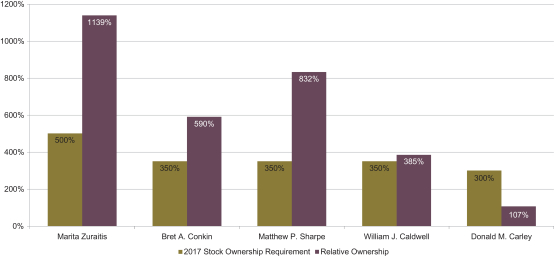

• Stock Ownership Requirementsownership guidelines for NEOs (500% of salary for CEO, 350% of salary for other NEOs) and a 12-month ➣ Twelve-month post-exercise holding requirement onfor stock options • Clawback Policypolicy applicable to both cash and equity awards • Executive Change In Control plan excludes “taxgross-up” provision • Executive Change in Control Plan excludes “tax gross-up” provisions Limited perks and executive benefits | | |

Pay PracticeGovernance Oversight The Committee oversees our executive compensation program. The current members of the Committee are Mr. Hasenmiller, Ms. McClure, and Mr. Shaheen. Mr. Hasenmiller serves as the Committee Chair. Consistent with the listing standards of the NYSE, the Committee is composed entirely of independent Directors. The Committee retained Compensation Advisory Partners LLC (“CAP”) as independent compensation consultants. CAP provides information and advice on the competitive market for executive talent, evolving market practices in our industry and the general employment market, regulatory and other external developments, and our executive compensation philosophy and incentive program design. In this way, CAP assists the Committee with ongoing education. Also, Committee members comply with Directors’ education requirement to help ensure each remains up to date on current issues relevant to the Company and its business. The CAP consultants report directly to the Committee, attend the Committee meetings and portions of executive sessions of the Committee at the Chair’s request (generally with the Board’s outside legal counsel, but without management present). CAP serves at the pleasure of the Committee, and performs no services for management. CAP works with management to obtain necessary data and perspectives on the Company’s strategic objectives, business environment, corporate culture, performance, and other relevant factors. This information is used by CAP to formulate its recommendations related to competitive compensation performance targets and overall design. CAP’s findings and recommendations are reported directly to the Committee. The services provided by CAP during 2017 are described in more detail throughout this CD&A. Pursuant to regulatory requirements, the Committee assessed CAP’s independence (along with that of its other direct and indirect | | | | 2018 Proxy Statement • Compensation Discussion and Analysis | | 21 |

consultants and advisors) in 2017 and concluded that CAP’s work did not raise any conflicts of interest. In addition, the Committee has the authority to hire other experts and advisors as it deems necessary. Management also supports the Committee by providing analysis and recommendations. When setting levels of executive compensation, the Committee requests, receives, and considers the recommendations of the CEO regarding the performance of her direct reports and other Executive Officers. Members of management also attend and contribute to Committee meetings as relevant to the Committee agenda. The Committee discusses its fundamental views on compensation and guiding principles, as well as its expectations of the CEO’s performance and annual goals, with the CEO and subsequently proposes the CEO’s goals to the Board for approval. The Committee does not include the CEO or other members of management in its discussions with CAP on the CEO’s compensation, nor does the CEO or management participate in the Committee’s recommendation to the Board on the CEO’s compensation. Say on Pay At the 2017 Annual Meeting of Shareholders, 70.3% of Shareholders voted, on an advisory basis, to ratify the NEOs’ compensation. This “Say on Pay” advisory vote reflected a significant decrease from the near-unanimous Shareholder support received from the 2011 through 2016 “Say on Pay” advisory votes (average of 97% in favor). The percentage of Shareholders who voted in favor of the 2017 NEO compensation was lower than the Committee and Board desired. Accordingly, we wanted to provide our Shareholders with additional information and context on how we are addressing the reduced 2017 affirmative “Say on Pay” advisory vote. We take this decline in our “Say on Pay” advisory vote seriously. Fundamentally, our goal is to link our executive compensation programs to long-term value creation and we believe we have had a long-standing record of accomplishing this goal. In response to the 2017 “Say on Pay” advisory vote and at the direction of the Committee, Company management solicited, and received, feedback from certain proxy advisory firms regarding the 2017 NEO compensation. In addition, through regular Shareholder outreach, Company management provided the opportunity for feedback regarding the 2017 “Say on Pay” advisory vote. Shareholders and proxy advisory firms were generally supportive of the Company’s overall compensation program in 2017. However, one advisory firm expressed a concern with executive compensation, based fundamentally onone-time strategic incentive grants provided to our NEOs in 2016, and recommended that the Company disclose threshold performance levels under the AIP and LTIP. Based on the feedback we received, we are making several changes and including additional disclosure in our CD&A. First, in an effort to ensure the Company’s executive compensation practices are closely aligned with the expectations of our Shareholders and provide additional insight to both our Shareholders and proxy advisory firms, the Committee is disclosing, annually, the peer group it considers when making executive compensation decisions. (See “Compensation levels should be market competitive” below for additional information). Second, the strategic incentive grants, which were described in depth in both the 2016 and 2017 Proxy statements, were designed to incentivize the achievement of both corporate financial goals and strategic individual goals in order to promote continuity of leadership as the Company pursues its long-term vision, and also strengthen management’s alignment with Shareholder interest. These awards were specifically designed to address key priorities during the Company’s strategic evolution, and are not an ongoing component of our executive compensation program. If the management team is successful in achieving these specific strategic objectives, the Committee believes it will drive incremental value for Shareholders. | | | | 22 | | 2018 Proxy Statement • Compensation Discussion and Analysis |

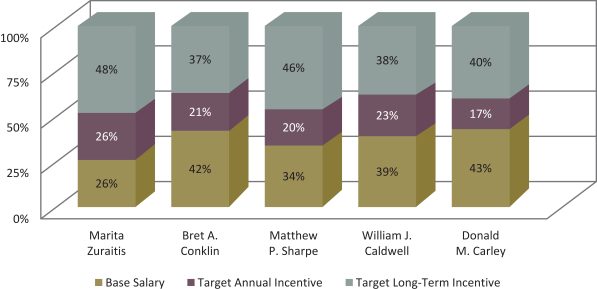

Third, threshold, target, and maximum performance levels for our 2017 AIP and 2015-2017 LTIP are discussed in more detail in the “Annual Incentive Plan” and “2015-2017 PBRSUs” sections below. For our 2018 Proxy, we are disclosing threshold levels for our AIP and LTIP. We consistently have disclosed, and will continue to disclose, our performance goals at the end of each respective performance cycle. The Committee continues to believe that the overall structure of our executive compensation plans, the absence of excessive perquisites, and our demonstratedpay-for-performance practices reflect the strength of the Company’s executive compensation programs. Frequency of “Say on Pay” Advisory Votes Pursuant to Section 14(a) of the Securities Exchange Act, the Board asked Shareholders to vote on the frequency of future “Say on Pay” advisory votes on NEOs’ compensation. Specifically, the Board asked whether “Say on Pay” advisory votes should occur every year, every two years or every three years. 76% of the Shareholder votes cast were in favor of annual “Say on Pay” advisory votes. The next vote on the frequency of future “Say on Pay” advisory votes will be conducted in 2023. Executive Compensation Program Guiding Principles The Committee has established a set of core principles that underlie our executive compensation program. These core principles provide guidance to the Committee and management in making decisions while administering the program or when considering changes. These core principles include strong alignment between pay and performance, incentive to drive Shareholder value, and market competiveness. Strong Paypay for Performanceperformance alignment We target compensation around the median of the competitive market, with executives earning more or less than median, generally based on the performance of the Company and value delivered to Shareholders. The overallOur core executive compensation program includes base salary, an annual cash incentive plan under the AIP, and long-term equity awards under the LTIP. Both the AIP and annual cash incentives.LTIP are administered under the Shareholder-approved 2010 Comprehensive Executive Compensation Plan, as amended (“CECP”). Incentive awards are earned upon the achievement of short-term and long-term business goals that are reviewed and approved by the Committee at the beginning of each performance period. Performance goals are structured to reward for business growth, profitability, and profitability,relative total shareholder return, balanced with productivity and risk and capital management. Executive interests should be aligned with Shareholders’ To encourage executive performance on a long-term basis, the Committee grants equity awards with multi-year performance periods and multi-year vesting. In 2017, Ms. Zuraitis received approximately 48% of her target compensation in equity. With respect to the other NEOs, approximately 37% to 46% of their compensation was equity-based. Incentive compensation should drive long-term value creation and reward strong performance The AIP performance goals are based on premiums and adjusted operating income to reward strong performance. The LTIP performance goals are directly linked to multi-year growth and return measures to keep executives focused on value creation. A significant portion of compensation should be “at risk” based on the Company’s performance For 2017, over 70% of the CEO’s target total pay (base salary, target annual incentive, and target long-term incentive) and over 60% of target total pay for all other NEOs is at risk, and is variable from year to year, and for much of it, the level of payout is dependent on the Company’s performance. | | | | 2018 Proxy Statement • Compensation Discussion and Analysis | | 23 |

Compensation levels should be market competitive The Committee sets total direct compensation for the NEOs – salary and target annual and long-term incentive opportunities – within a reasonable range of the median of the competitive market, while providing the ability to decrease or increase compensation if warranted by performance and experience. To determine competitive pay levels, we use an established peer group of similarly sized insurance companies in the Russell 2000® Index. The Committee worked with CAP to select our peer insurance companies for 2017, based upon assets under management and revenue. The peer group includes the property and casualty, life and health, and multi-line insurance companies charted below. The peer group does not include reinsurance or insurance brokers. We supplement this information with survey market data from published sources including LOMA, Towers Watson, and Mercer. The data from these surveys is scaled to our size by CAP based on revenues or asset ranges. Annually, CAP provides the Committee with a comparison of the base salary, annual incentives and long-term incentives of the CEO with those of other Chief Executive Officers based on the peer group and survey data obtained. The Committee does not seek to benchmark or set executive compensation at any specific level relative to the peer group. Instead, the Committee uses this information primarily as a general reference point for seeking to determine pay levels and forms of plan design that effectively recognize favorable executive performance and experience, and ensure executive retention. For 2017, CAP’s analysis demonstrated that Ms. Zuraitis’s overall core total direct compensation was consistent with target pay positioning at the median of the market. The other NEOs are assessed against comparable functional matches in the insurance industry and the broader general industry, as appropriate. Based on the data received, and CAP’s analysis, the Committee deliberates in executive session to determine its recommendation for approval by the Board. | | | | | 2017 Peer Group | | | | Ambac Financial Group | | Kemper Corporation | | RLI | | | | American Equity Investment Life | | MBIA | | Selective Insurance Group | | | | Argo Group International | | National General Holdings | | State Auto | | | | CNO Financial Group | | National Western Life Group | | The Navigators | | | | Employers Holdings | | One Beacon Insurance | | United Fire Group | | | | FBL Financial Group | | Primerica | | |

| | | | 24 | | 2018 Proxy Statement • Compensation Discussion and Analysis |

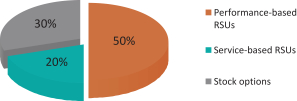

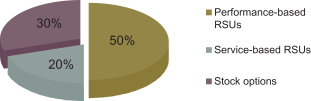

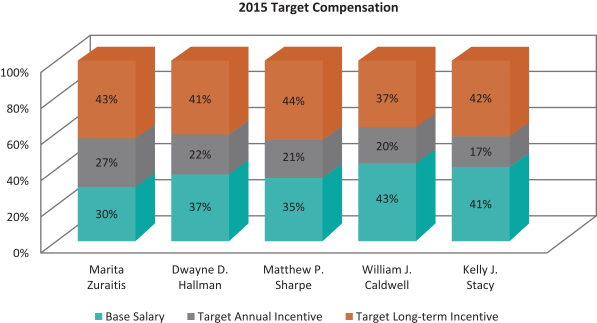

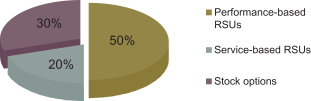

Compensation Mix Our NEOs’ annual compensation consists of base salary, annual incentives and long-term incentives. The targeted compensation mix of total direct compensation for the NEOs for 2017 is illustrated below. The mix of 2017 actual compensation varied as a result of actual incentives earned.

Base Salary Competitive base salaries are critical to attracting and retaining high performing executive talent. The Committee seeks to pay salaries that approximate median salaries for executives of similar companies in like positions. However, in recruiting new executives, we sometimes exceed these guidelines to attract qualified candidates. There may also be instances where an existing executive’s compensation deviates from the median, up or down, due to experience, performance, responsibilities, compensation history, internal equity, or retention risk. Salaries for the NEOs and other executive officers are reviewed every 12 months in connection with the review of financial results for the prior fiscal year and the annual performance review discussed under “Annual Performance and Pay Review” below. In 2017, Ms. Zuraitis, Mr. Sharpe, and Mr. Caldwell received base salary increases to move overall compensation closer to the market median. Mr. Conklin received a base salary increase to recognize his promotion to EVP and CFO. Mr. Carley did not receive a base salary increase in 2017. Base salary adjustments for 2017 are shown in the chart below. | | | | | | | | | | | | Named Individual | | 2016

Annualized

Salary | | | 2017

Annualized

Salary | | | Percent

Increase | Marita Zuraitis | | | $800,000 | | | | $850,000 | | | 6.3% | Bret A. Conklin | | | $275,000 | | | | $320,000 | | | 16.4% | Matthew P. Sharpe | | | $400,000 | | | | $415,000 | | | 3.8% | William J. Caldwell | | | $350,000 | | | | $375,000 | | | 7.1% | Donald M. Carley | | | $300,000 | | | | $300,000 | | | 0.0% |

| | | | 2018 Proxy Statement • Compensation Discussion and Analysis | | 25 |

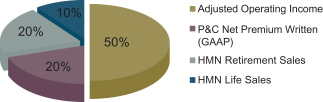

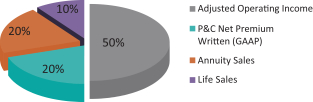

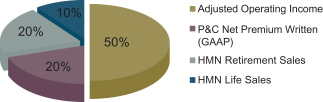

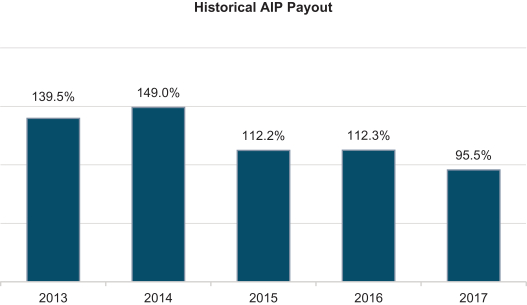

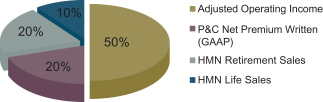

Annual Incentive Plan Our AIP is a cash incentive plan, administered under the CECP, and designed to drive and reward strong performance over aone-year period. Annually, the Committee establishes the performance objectives, threshold, target and maximum performance levels, and the related threshold, target and maximum AIP opportunities for each NEO, expressed as a percentage of base salary. Target incentive opportunity levels for the NEOs are intended to approximate the median of the target bonus potential for similarly situated executives in comparable companies. Maximum incentive opportunities are set at 200% of target. For 2017, there were four performance measures, with 50% of the award based on Company-wide net operating income, and the remaining 50% divided among specific sales and premiums of the different business lines: P&C net written premium (20%), retirement sales (20%), and life sales (10%), as shown in the chart below. This provides a balance between shareholder return and growth, while complementing the longer-term LTIP metrics, which focus on long-term shareholder value creation. 2017 Annual Incentive Plan Performance Measures | | |  | | Adjusted Operating Income - Operating income (GAAP net income after tax, excluding realized investment gains and losses other than those for Fixed Indexed Annuity related options and embedded derivatives) adjusted for P&C catastrophe costs different than the annual Plan, Annuity & Life deferred acquisition costs (“DAC”) unlocking and change in guaranteed minimum death benefit (“GMDB”) reserve due to capital gains and losses and market performance different than Plan, the impact on investment income of share repurchases different than Plan, and debt structure/costs including debt retirement different than Plan. P&C Net Premium Written (GAAP) - Amount charged for property and casualty policies issued during the year. (Portions of such amounts may be earned and included in financial reports over future periods.) Retirement Sales - The amount of new business from the sales of Horace Mann annuity products, from Horace Mann and independent agents, as measured by premiums and deposits to be collected over the 12 months following the sale. Life Sales - The amount of new Horace Mann individual life insurance products sold during the year, as measured by premiums and deposits to be collected over the 12 months following the sale. |

All the NEOs’ 2017 annual incentive amounts are based on the same corporate and business line objectives to promote cooperation. The targets for the operating income and sales or premium | | | | 26 | | 2018 Proxy Statement • Compensation Discussion and Analysis |

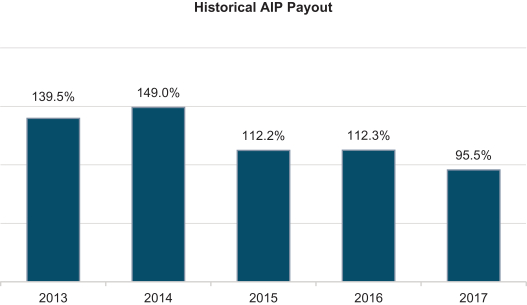

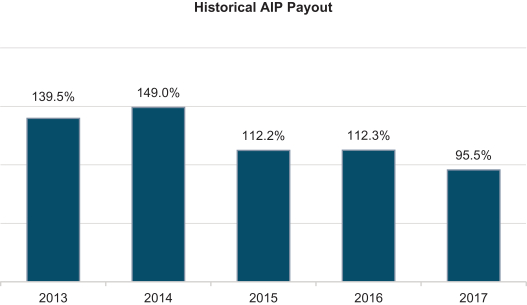

measures were based on a review of market conditions and expectations of other companies in the industry as well as our financial plan for 2017 (“2017 Plan”). The 2017 Plan was the basis of our 2017 earnings guidance, which was publicly disclosed in February 2017 in connection with our release of earnings for the year ended December 31, 2016. The Committee believes that tying the AIP to Company performance provides appropriate alignment for an executive’s compensation as it recognizes that the Company as a whole must perform well in order to deliver value to our Shareholders. Further, tying all the NEOs’ AIP awards to the performance of specific business lines incentivizes cooperation among the business line leaders. It is the goal of the Committee to establish measurements and targets that are reasonable, but not easily achieved. The measures and targets are discussed with the CEO, other NEOs, other members of the Board and CAP before they are set. Each March, the Committee certifies performance and determines AIP payouts for the prior year. Based on the 2017 results of 95.46% of target for Ms. Zuraitis and the other NEOs, the 2017 AIP payouts (paid in March 2018) were as follows: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2017 AIP Measures (in $M) | | Threshold | | Target | | Maximum | | Actual | | Results | | Weighting | | Payout | Adjusted Operating Income | | | | 77.9 | | | | | 83.8 | | | | | 92.5 | | | | | 87.2 | | | | | 139 | % | | | | 50 | % | | | | 69.48 | % | P&C Net Premium Written | | | | 651.7 | | | | | 662.7 | | | | | 673.7 | | | | | 662.8 | | | | | 101 | % | | | | 20 | % | | | | 20.18 | % | Horace Mann Retirement Sales | | | | 422.3 | | | | | 435.3 | | | | | 448.3 | | | | | 367.3 | | | | | 0 | % | | | | 20 | % | | | | 0.00 | % | Horace Mann Life Sales | | | | 17.6 | | | | | 18.5 | | | | | 19.4 | | | | | 17.74 | | | | | 58 | % | | | | 10 | % | | | | 5.80 | % | Total | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 100 | % | | | | 95.46 | % |

| | | | | | | | Named Individual | | 2017 Target

AIP Opportunity1 | | 2017 Actual

AIP Payout | | 2017 Actual AIP Payout

as a % of Base Salary | Marita Zuraitis | | 100% | | $803,455 | | 94.52% | Bret A. Conklin | | 35%/50% | | $134,200 | | 41.94% | Matthew P. Sharpe | | 60% | | $236,264 | | 56.93% | William J. Caldwell | | 60% | | $212,398 | | 56.64% | Donald M. Carley | | 40% | | $114,552 | | 38.18% |

(1) Mr. Conklin’s Target AIP Opportunity was increased to 50% upon his promotion to EVP & CFO

| | | | 2018 Proxy Statement • Compensation Discussion and Analysis | | 27 |

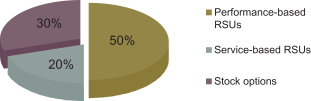

Long-term Incentive Plan Our Long-term IncentiveThe intent of our LTIP is comprisedto focus executives on shareholder value and key strategic objectives, while promoting retention.

2017 LTIP Aggregate Target Opportunity In setting the dollar values of three vehicles, performance-based RSUs, service-based RSUs and stock options,the 2017 opportunities under LTIP for each NEO, the Committee targeted amounts that would achieve the Company’s overall objective of positioning total compensation at approximately the market median. The 2017 target grant values for the NEOs were as described below. The performance-based RSUs provide an effective vehicle for rewarding executives based on a three-year performance period and have a high value in promoting executive retention. The performance-based RSUs, along with the service-based RSUs and stock options provide strong alignment with Shareholder interests and assist in the retention of key executive talent. Long-term Incentive Vehiclesfollows:

| | | | |  Named Individual | | 2017 LTIP

Target | | Marita Zuraitis | | | $1,550,000 | | Bret A. Conklin | | | $280,000 | | Matthew P. Sharpe | | | $565,000 | | William J. Caldwell | | | $360,000 | | Donald M. Carley | | | $285,000 | |

2017 LTIP Award Vehicles For 2017, LTIP is comprised of three vehicles, as illustrated in the chart below: (1) performance-based RSUs; (2) service-vested RSUs; and (3) service-vested stock options. | | |  | | Performance-based RSUs - Earned over a three-year period, based upon Relative and Absolute Measures. If any shares are earned at the end of the three-year performance period, the executive fully vests in the award | | | Service-basedService-vested RSUs - Vest 1/ratably over 3 per year after years 1, 2 and 3

| | | Stock options - Granted at fair market value with a 10 year life; options vest ratably over 4 years |

Performance-Based RSUs (PBRSUs) | | | 12 | | 2016 Proxy Statement • Compensation Discussion and Analysis |

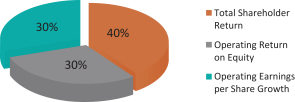

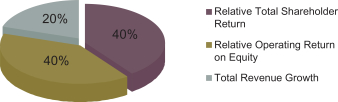

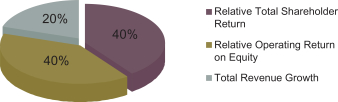

Long-term Incentive Plan Performance-based Measures

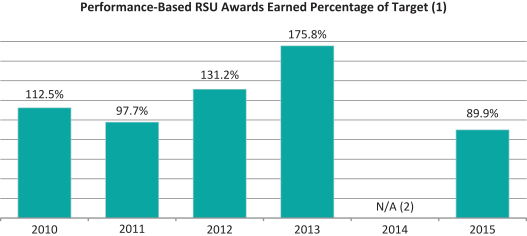

Our Long-term Incentive performance-based measures coverThe Committee believes that PBRSUs provide an effective vehicle for rewarding executives based on a three yearthree-year performance period. Each year, a new three yearthree-year period starts, partially overlapping the periods that started the prior two years. PBRSUs were granted on March 7, 2017 for the 2017-2019 performance period, and comprise 50% of the 2017 LTIP opportunity. These RSUs will be earned and vested on December 31, 2019, based on the level of achievement, though no RSUs will be earned if threshold level of performance is not achieved. From the date of grant, PBRSUs accrue dividend equivalents at the same rate as dividends paid to our shareholders, but the dividend equivalents are only paid on the corresponding shares that are earned. If no shares are earned, the dividend equivalents are forfeited. Earned dividend equivalents are converted into additional RSUs.